What is Technical Analysis TA? Definition & Trading Examples

Contents:

The issuers of these securities may be an affiliate of Public, and Public may earn fees when you purchase or sell Alternative Assets. For more information on risks and conflicts of interest, see these disclosures. Identifying trends – being able to identify trends is vital since the market is known to repeat them. Knowing when there’s a continuation of a trend, a stall, or a trend reversal offers investors opportunities to capitalize on when to enter or exit the market to profit from buying or selling at the optimal times.

To begin with we understand the bullish and bearish engulfing pattern with real examples f .. Basic concepts on various candlestick patterns used by traders to make decisions on the market. We also discuss the basic classification of candlestick patterns .. Moving averages and most other technical indicators are primarily focused on determining likely market direction, up or down. There are dozens of different candlestick formations, along with several pattern variations. It’s certainly helpful to know what a candlestick pattern indicates – but it’s even more helpful to know if that indication has proven to be accurate 80% of the time.

Founder Roman Kaan Announces That RK Trading Surpasses … – Digital Journal

Founder Roman Kaan Announces That RK Trading Surpasses ….

Posted: Mon, 17 Apr 2023 18:18:47 GMT [source]

The Elliott Wave Theory is the interpretation of market processes through a graphical system of wave patterns. This allows the analyst to filter out false signals and make more accurate predictions. Sectoral analysis to identify strong and weak assets by industry or other differentiating factor.

Learning Outcomes

For such a system, traders generally buy or take long positions in assets that are in an uptrend. This assumption is also referred to as the efficient market hypothesis, which allows traders to ignore all fundamental factors that could affect an asset. Therefore, technical analysts and traders typically focus solely on analysing the instrument’s price movements. Some traders use white and black candlestick bodies ; other traders may choose to use green and red, or blue and yellow. Whatever colors are chosen, they provide an easy way to determine at a glance whether price closed higher or lower at the end of a given time period. Technical analysis using a candlestick charts is often easier than using a standard bar chart, as the analyst receives more visual cues and patterns.

The bottom-up method is useful for best way to learn technical analysising individual stocks, commodities, or currencies that are outperforming, irrespective of market, industry, or macro trends. Momentum oscillators can be viewed as graphical representations of market sentiment that show when selling or buying activity is more aggressive than usual. Technical analysts also look for convergence or divergence between oscillators and price. Someone who uses technical analysis is called a technical analyst.

Price Action

Some examples include simple moving averages, exponential , or weighted . The 4-hour chart of USD/SGD below illustrates the value of a momentum indicator. The MACD indicator appears in a separate window below the main chart window. The sharp upturn in the MACD beginning around June 14th indicates that the corresponding upsurge in price is a strong, trending move rather than just a temporary correction. When price begins to retrace downward somewhat on the 16th, the MACD shows weaker price action, indicating that the downward movement in price does not have much strength behind it.

Chart Patterns PDF Free Download With Technical Analysis – Gkbooks

Chart Patterns PDF Free Download With Technical Analysis.

Posted: Sun, 16 Apr 2023 08:14:11 GMT [source]

The skills covered in technical analysis courses may include understanding price chart patterns, behavioral finance principles, and analysis-based trading opportunities. Certification options may provide an overview of the principles of predicting and understanding market behaviors and broader economic principles. This knowledge can help you prepare for a data-driven career as a technical analyst. Unlike fundamental analysis, technical analysis does not take into account external fundamental factors that influence the value of a stock, such as competition or demand for a company’s products. In their forecasts, technical analysts use tools to search for patterns on charts and perform arithmetic calculations.

What is multiple timeframe analysis?

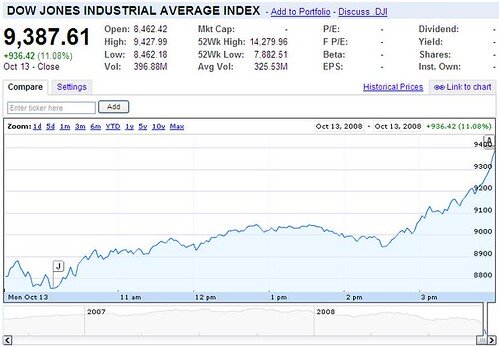

TA is based on the analysis of the retrospective price movement and its interpretation for the future. The trader makes decisions based on patterns of behavior in the past and assumes that they will repeat in the future. Due to this approach, a novice trader may have a false sense of foreseeing the future, which is a big mistake. Any trading decision made on the basis of technical analysis is probabilistic and evaluative. The above chart displays a five-wave bullish pattern and a double zigzag. If you mark the price chart in this way, you can anticipate the future price movement.

Stocks can continue trading higher long after they become overvalued. Selling a stock just because it is expensive often means missing out on a large percentage of a rally. By using price and volume trends you can continue to hold the stock until the momentum is exhausted. Top-down traders or day traders look at the overall economy rather than focusing on individual stocks. At first, they would approach their analysis by looking at the economy, sectors, and then stocks of companies. It is used mainly for short-term views, for example, daily trade opportunities, rather than monthly.

AxiTrader is not a financial adviser and all services are provided on an execution only basis. Information is of a general nature only and does not consider your financial objectives, needs or personal circumstances. Important legal documents in relation to our products and services are available on our website. You should read and understand these documents before applying for any AxiTrader products or services and obtain independent professional advice as necessary.

Technical analysis consists of several components, including trend analysis, chart patterns, indicators, Fibonacci number sequence, risk and reward analysis and moving averages. Trend analysis is a way to identify the overall direction of price movement, whether it is up, down or sideways. Chart patterns help analysts predict future price movements based on the shape of the price action, such as head and shoulders or double-bottom patterns. Indicators, such as the MACD, show when a trend may be reversing from a bullish to a bearish signal. Fibonacci number sequences are used to identify potential points of support and resistance. Risk and reward analysis helps to determine the ideal resistance and support levels to place buy and sell orders.

Share Market trading tips

The Fibonacci retracement levels will enable you to define potential points where the waves should start and finish. You can learn more about the Elliott Wave Theory, wave patterns, and the identification rules for each wave in the series of training articles devoted to this topic. The first article you should start with isMarket Wave Theory by Robert Prechter. This method is simpler than the previous one, but it has several disadvantages. The bottom-up trading approach involves focusing on the performance of individual companies or sectors.

You should consider whether you understand how over-the-counter derivatives work and whether you can afford to take the high level of risk to your capital. Investing in over-the-counter derivatives carries significant risks and is not suitable for all investors. Package is another useful tool that can prove to be very valuable to traders – from sentiment indicators to correlation tools. The MACD is a technical momentum oscillator that plots two exponential moving averages, one of which has been subtracted from the other to create a signal line or “divergence” and then added back to it . There are a large number of indicators available, and it is easy to get lost and suffer from information overload. Generally, it is better to stick to 1-3 technical indicators, as having too many on your chart could generate conflicting signals.

- After the end of the correction, the trend, as indicated by the figure, continued.

- In the financial markets, technical analysis is the study of behavioral economics, risk management and trends, all of which can be applied to trading.

- This is noticeable in the subsequent correction, which ended just at this level due to its low potential .

- This is not an offer, solicitation of an offer, or advice to buy or sell securities or open a brokerage account in any jurisdiction where Open to the Public Investing is not registered.

But in fact, the CMT Association’s website has a treasure trove of learning resources. While the website design might look plain, its contents are solid. On the website, you will find the key findings of each chart pattern including rules and backtesting results.

Industry data and economic factors, like interest rates and retail spending, are also used to forecast future growth rates. Ultimately, a fair value is arrived at after comparing several models and ratios. Gives a idea of entry and exit prices required to optimize trades. Moreover, there is also a lot of education material online that is free of charge if you are tight on budget. Still, one of the best and fastest ways to learn is to seek out professional traders who could teach you personally one-on-one.

Is one of the most https://trading-market.org/ trading platforms available, and it gives you the opportunity to access a wide variety of indicators, as well as drawing tools. Each of these patterns tells us a different story about what we could expect from the price movement. 22.1 Trade from charts If you are familiar with Zerodha’s trading terminal, Kite, you probably know that you can choose to analyze stock/index charts either on Tradingview or on ChartIQ.

The other great contribution to technical analysis comes from Japan, where a specific type of chart was used for tracking the price of rice since the 1600s. There are many factors that traders look at and analyze when choosing a futures contract to trade. Some traders might look for trends on a chart while other traders might look to see if demand might be increasing for a commodity. Oscillators are a group of technical indicators that attempt to indicate the strength of a trend and if a market is over-bought or over-sold. Relative strength analysis is based on the ratio of the prices of a security and a benchmark and is used to compare the performance of one asset with the performance of another asset.

Learn To Trade

Technical analysis maintains that all fundamental information is already reflected in the market price, but that other variables, such as market sentiment, can influence pricing. For example, in financial markets, specific patterns in investors’ trading behavior may start to repeat over time; technical analysis can help account for these factors and thus predict future price movements. Technical analysts use chart patterns and trends, support and resistance levels, and price and volume behavior to identify trading opportunities with positive expectancy. Technical analysis does not consider the underlying business, or the economics that affect the value of a company. These signals can help investors accurately forecast future price movements and know whether to buy, hold, or sell their assets. In addition, technical indicators are generally used to obtain additional information in combination with basic chart patterns – placed over the chart data to predict where prices might be heading.

The candlestick essentially indicates a rejection of the extended push to the downside. Countless trading books have been authored and some on technical analysis have withstood the test of time and are go-to resources for novice traders. Also, many courses are also available on and offline, including Investopedia Academy’s Technical Analysis. Novice traders can turn to books and online courses to learn about technical analysis. The dead cat bounce is a price hike and a return back to the bottom of growth.

Choosing which indicators to use is based on personal preference and understanding how they work. Strategies can include using more than one, but using too many at once can be confusing. Utilizing resources effectively – analyzing charts helps identify the best time to buy and sell as you learn to see the signals. Fundamental analysis studies stocks by evaluating their intrinsic value, which is the method of identifying the financial worth of a company and its cash flow.

With his guidance, viewers can gain valuable knowledge to help them become more successful investors. Trader For Tomorrow is a YouTube channel run by The Financial Doctors, Vishwa Kalra, offering a comprehensive range of learning tools for intraday trading, technical analysis, and trading strategies. The channel features detailed tutorials on technical indicators, stock market analysis, and analysis in Hindi. It provides viewers a platform to understand the complexities and intricacies of the stock market.

On the other hand, fundamental analysis might require access to certain tools that can be expensive. Technical analysis is more suitable for beginners as the information is easier to process. Applying fundamental analysis requires a solid understanding of not only macroeconomics but other factors that can influence the markets, like geopolitics. To get a better understanding of why technical analysis can have its ups and downs, refer to the pros and cons of using technical analysis when trading. Support and resistance levels are areas where the price of an asset is likely to reverse or stage a breakout.

- In this respect, technical analysis is similar to fundamental analysis, which has specific rules for calculating ratios, for example, but introduces increased subjectivity in the evaluation phase.

- Overall, even though technical analysis can be a helpful trading tool, it is crucial to remember it isn’t perfect and always completely accurate.

- Oscillators are a group of technical indicators that attempt to indicate the strength of a trend and if a market is over-bought or over-sold.

- Applying fundamental analysis requires a solid understanding of not only macroeconomics but other factors that can influence the markets, like geopolitics.

- On most charts, if the horizontal left line is lower than a horizontal line on the right, then the bar will be shaded green, representing a growth period.

If you invest in an unlisted company, fundamental analysis is all you have available to work with. But, when it comes to listed stocks, there is a lot that can be learnt from their trading history. The price of tradeable securities is also affected by a lot more than the underlying fundamentals. It is believed that the past movements of the price get reproduced in the present and the future. It happens because traders tend to react to specific things they see on the charts in the same way for psychological and emotional reasons. It’s possible to identify specific patterns and expect that these patterns will occur in the future causing the same price action that they used to provoke in the past.

Các Tin Khác

- Choosing a Research Paper Writing Service

- Steve Hovland, manager regarding search getting Irvine, California-based HomeUnion, mentioned that education loan obligations has actually slowed down growth in this new You

- If There is nothing Read on your part Else Now, Research Which Report on Panamanian Females

- The Mental Aspects of Allowed away from Cosmetic plastic surgery

- 0 05 Ethereum To Us Dollar Or Convert 005 Eth To Usd

- Just how Carry out These Fundings Notice?

- That is precisely what we will use with this Tinder means

- mariobet - Mariobet Giriş Etiketli Haberler

- Best Interracial Dating Sites

- Additionally the cleaning isn’t your problem!